Top 5 AI Technologies Transforming the Future of Banking

- Kate Podgaiskaya

- Jun 20

- 20 min read

Updated: Jun 27

The financial sector is in the midst of a tectonic shift—one propelled not by policy change or market fluctuation, but by artificial intelligence!

AI, once a futuristic premise relegated to the preserve of research labs and science fiction, has matured with dizzying rapidity to become the paramount disruptive force in banking today. What began as an operational experiment—used behind the scenes for fraud detection or process automation—has become a mission-critical pillar of the modern financial institution.

Banks across the globe are moving away from one-size-fits-all products, manual processes that are time-consuming, and reactive risk management. AI is now bringing in a new era of intelligent, hyper-personalized, and proactive banking.

It is no longer sufficient to process transactions in a timely manner or provide competitive prices. The future will be owned by those institutions that are able to anticipate customer needs before they arise, manage sustained risk in real time, and provide frictionless experiences across physical and digital channels—all driven by data and machine learning.

The technologies behind this revolution aren't just improving performance—they're changing what's possible in banking. In this article, we'll examine the five AI technologies making the biggest difference in finance. From predictive analytics to intelligent automation, these technologies aren't just tools—they're the foundations of a new kind of banking—faster, more equitable, and a whole lot smarter.

Executive Summary

No longer are banks in the business of merely shifting money—banks today shift minds, make forecasts, and remain ahead in a progressively intricate universe of finance. At the center of everything is artificial intelligence.

Much more than an IT upgrade, AI is the strategic necessity for banks to prosper in a hyper-digital world. Its inclusion in core banking activities is not just transforming the way services are provided but also transforming the customer experience, the risk profile, and even the business models that support contemporary finance.

Artificial intelligence is no longer a behind-the-scenes supporting actor. It has moved to the front as a differentiator distinguishing the industry leaders from the laggards. The most progressive banks now utilize AI solutions that do not just examine enormous amounts of data, but also make independent decisions, learning all the while and enhancing results overall. From providing real-time credit determinations to revealing intricate patterns of fraud, AI enables a degree of precision and personalization impossible for manual systems. In fact, tools like an ai detector are now being used to verify content authenticity and ensure responsible use of generative technologies within financial communications.

In this article, we concentrate on the five most influential AI technologies revolutionizing the future of banking.

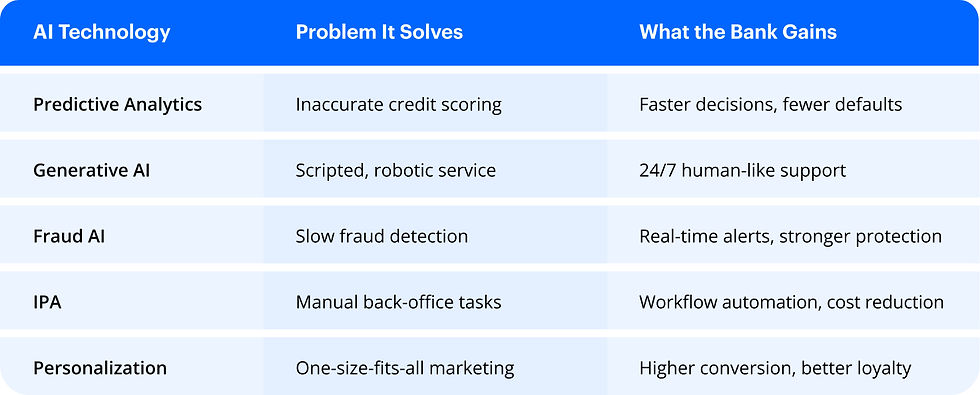

Predictive analytics is revolutionizing credit assessment and risk management. Customer engagement is being made a two-way conversation instead of a broadcast by Generative AI. AI-driven fraud detection products are empowering institutions with the ability to stop financial crime from occurring in the first place. Intelligent process automation is simplifying operations and reducing costs without any loss of accuracy.

Lastly, real-time personalization platforms are enabling banks to foresee and address each customer's needs at the moment. Collectively, these technologies are not only streamlining financial services—they are creating a smarter, quicker, and more accessible tomorrow for banking.

Predictive Analytics for Credit & Risk Scoring

Preview Predictive analytics is fast emerging as the nerve center of risk and credit strategies in banking today. By meshing in the knowledge of the past with the intelligence of real-time behavior, AI-driven models are now able to make extremely precise forecasts of the willingness of a borrower to repay. Conventional scoring approaches, based on rigid rules and stale credit bureau information, are making way for intelligent systems that learn and evolve continuously.

Here, we'll take a closer look at what predictive analytics is, how it's being utilized in actual banking, the technology driving its expansion, and the quantifiable effect that it's having on banks and bank customers.

What It Is

Banking predictive analytics is an advanced use of artificial intelligence and machine learning that seeks to project future events based on previous behavior and trends. In contrast to traditional credit-scoring programs, which were developed from a limited number of important variables—i.e., income, debt burden, payment history—newer predictive algorithms are trained using large amounts of data.

They keep on learning from both structured information, such as salary payments and transaction history, and unstructured ones, such as social signals, mobile usage patterns, and even geographic information.

The thing that is distinctive about predictive analytics is that it can run in real time. Instead of waiting for monthly reports or quarterly overviews, banks can assess the financial well-being of a customer on an ongoing basis.

An abrupt reduction in expenditure, a spike in short-term loans, or a change in the way a person settles their bills might promptly activate a reevaluation of their risk profile. Since these systems are self-learning, they get better with the passage of time, recognizing faint patterns that humans or rules-based systems would fail to catch. This adaptive responsiveness renders predictive analytics a much more effective instrument compared to conventional risk-scoring techniques.

Use Cases

On a practical level, predictive analytics is transforming some of the most fundamental elements of banking behind the scenes. One of its most significant uses is in loan underwriting. Rather than necessitating pages of paperwork and tedious review, AI algorithms can assess an applicant's creditworthiness in a matter of seconds based on hundreds of criteria outside of their FICO score.

This not only speeds up approvals—it also opens up credit to people who might not have a traditional credit history, like gig economy workers, students, or individuals in emerging markets.

Beyond individual lending, predictive analytics is also essential to risk management at the portfolio level. Banks and other financial institutions are using it to monitor and segment their customer bases based on evolving risk factors. For example, a bank can now identify clusters of borrowers that are becoming increasingly vulnerable to economic shocks and take early action—offering flexible repayment terms or restructuring proposals to preempt defaults. Another priority area is early warning systems.

These models don't simply examine present financial health—they foresee future difficulty. As soon as a borrower begins to exhibit signs of trouble, for example, missing a payment or drawing down savings quickly, the system identifies this activity long before it becomes a default. This early warning allows the banks to cover their assets while also providing customers with an increased opportunity to recover.

Key Technologies

At the heart of predictive analytics are some of the most sophisticated machine learning frameworks that exist today.

Some of the most popular are gradient boosting algorithms like XGBoost and LightGBM. These algorithms are most appropriate to financial data sets, where speed and accuracy are everything. They are highly effective with big data, can predict accurately with missing or imbalanced data, and can be trained swiftly to adapt to evolving market trends.

For analyzing more complicated, nonlinear relationships, when necessary, it employs neural networks. These AI models mimic how the human brain works to process information, enabling them to identify patterns in behavior that may not be apparent using linear algorithms.

They are particularly helpful in making long-term risk predictions, since borrowers' behaviors over time evolve in reaction to individual and macroeconomic factors. For optimal predictability, the majority of financial institutions are transitioning to ensemble models today. These platforms blend several algorithms—typically a mix of decision trees, neural nets, and regression models—to generate more precise and robust predictions. The outcome is a scoring system that is nuanced but powerful, capable of learning from new data without sacrificing reliability.

Impact

The injection of predictive analytics into banking has delivered tangible benefits across the board. Credit decisions that once took days—or even weeks—are being rendered in minutes, with no compromise on accuracy.

Not only does this accelerate customer satisfaction but also reduces the cost of operations of underwriting by eliminating redundant manual checks and paperwork. Most importantly, banks are seeing real gains in loan quality. Use of predictive models has seen measurable reductions in non-performing loans since institutions can respond earlier when borrowers initially begin to slip. With earlier warning of emerging risk, they can tailor solutions before things spiral out of control—protecting both financial health and the customer relationship.

The most revolutionary effect of all, however, is in financial inclusion. By tapping into alternative data and using AI to evaluate creditworthiness more comprehensively, banks are unlocking their doors for millions of people who were previously shut out from formal financial networks. Individuals with thin credit files, irregular income, or non-traditional financial histories are now being seen, understood, and served. In this manner, predictive analytics is accomplishing more than streamlining risk management—it's transforming the very definition of creditworthiness in today's world.

Customer Interaction with Generative AI

Gone are the days of wait times and canned responses. Generative AI, powered by large language models, is transforming the way banks engage with customers. These platforms can speak, explain, personalize, and even predict needs, all in natural language. Whether it is responding to questions in seconds, creating personalized investment news, or automating financial guidance, GenAI is the power behind more intelligent and more scalable engagement.

Here we outline how banks are utilizing LLMs like ChatGPT and Claude not only to reduce expenses, but to build richer, more human-like connections with millions of customers—simultaneously and intelligently.

What It Is

Generative AI, and the large language model specifically, represents a revolution in the way that banks, or really any enterprise, can engage with customers. The traditional, script-based chatbots, which operate through narrow decision trees, are quite a different animal from these models, which learn from enormous and varied datasets, allowing them to grasp context, intent, tone, and even the subtleties of financial terminology.

What this delivers, is a system capable of conducting actual conversation, deciphering subtle inquiry, and responding in ways remarkably akin to human. These models do not just answer questions—they learn. They are able to translate complex financial prose into plain English, render jargon into plain talk, and adjust their tone based on who they are writing for. A customer asking questions about mortgage offerings can receive a summary or thorough analysis, based on their level of knowledge. Because the models learn through experience, their accuracy and relevance improve with each use.

This capacity for intelligent, context-aware dialogue at scale is what makes generative AI a customer conversation game-changer.

What's especially powerful for banking in this case is having the ability to integrate these capabilities into multiple touchpoints. By mobile app, website chat, email, or voice assistant, banks can now deliver around-the-clock intelligent support without sacrificing empathy or precision. The days of annoying help desk loops and template answers are fast disappearing into one-to-one conversations tailored to the individual needs of the customer.

Use Cases

Generative AI is also behind the scenes transforming the daily tasks of customer engagement teams. The most obvious and immediate application is in AI-driven support. Virtual agents powered by language models can now resolve tier-one and tier-two issues that required big human teams before. These agents don't just respond—comprehend. They recognize when a user is upset, ask clarifying questions where necessary, and offer contextually relevant responses based on more than a keyword match.

Beyond support, these systems are emerging as virtual financial advisors for the typical user. Here's a scenario: you sign into your banking app and you're greeted by a proactive message that analyzes your spending patterns, suggests savings potential based on your behavior, or alerts you to investment prospects based on your risk profile. These are not mere alerts—they are dynamically generated insights based on real-time data and personalized preferences.

The outcome is a relationship that, instead of a one-way communication, resembles a dialogue with an in-house banker.

Another intriguing application is in outbound communications. Rather than sending mass-blanked emails or messages, generative AI can generate personalized product referrals, loan status updates, or portfolio overviews for every customer. Whether reminding a person of an impending payment due date or proposing a more attractive interest rate reflecting recent transactions, the system converts marketing into valuable, timely engagement. Each message becomes relevant, useful, and optimally timed—precisely what customers expect from a contemporary financial partner.

Major Technologies

The center of the revolution is large language models and specifically GPT models designed by OpenAI and Anthropic's Claude models. These models are pre-trained on huge corpora of data from books, websites, codebases, etc., that enables them to develop a strong grasp of language and reasoning. However, for banking applications, pure general-purpose intelligence is not sufficient.

That's where fine-tuning kicks in—these models are further trained on finance data, regulatory lingo, and customer interaction logs so that they become domain-fluent.

To take relevance even further, certain banks are bringing in retrieval-augmented generation systems. In this hybrid design, the model's responses are augmented by enabling the model to draw in the newest, most up-to-date information from policy guides, customer records, and internal knowledge bases. Rather than depending on what it memorized during training, the model consults real-time, bank-specific information for responses that are not just fluent but also factually accurate and align with current procedures.

As deployment scales up, banks are also investing in governance layers and instant engineering to provide consistency, compliance, and safety. These models are not being simply plugged into customer service pipelines—they are being tightly monitored, constrained, and steered to act in a controlled and explainable manner.

It is this combination of state-of-the-art models, retrieval mechanisms, and bank-level customization that allows generative AI to offer truly intelligent, secure, and compliant interaction at scale.

Impact

The use of generative AI in banking has yielded stellar returns on many levels. Customer service, traditionally a cost center, has become an efficiency and satisfaction driver. Wait times have plummeted, and first-contact resolution rates have increased exponentially.

Customers receive their answers more quickly, in a more suitable format, and on their preferred channel. These benefits have directly resulted in increased satisfaction and greater brand loyalty.

For the banks, the operational advantages are equally compelling. Liberating human agents by automating routine interactions enables them to concentrate on complex, emotionally fraught, or challenging problems where creativity and empathy are still vital. This shift not only lowers the cost of support but also fosters more high-quality service overall. In the meantime, the ability to personalize at scale means that each customer gets messages that seem timely and relevant, which optimizes conversion and develops relationships.

Most of all, generative AI is changing customer expectations. Humans no longer measure banks against other banks—instead, they measure them against the frictionless, conversational experience they enjoy with AI assistants, e-commerce sites, and digital products in other areas of their lives. Banks that provide intelligent, human-like interaction at scale appear more innovative, more human, and ultimately more trustworthy. In a digital-first world, impressions like these are valuable—and generative AI is making them possible.

AI-Powered Anti-Fraud and AML Solutions

Fraudsters do not sleep, and neither should your fraud detection software. Machine-learning-based AML and fraud detection software has the capacity to watch thousands of transactions in milliseconds, identifying suspicious activity long before it would trigger alarm bells in humans. Here, we discuss the AI technologies turning static rules into adaptive, dynamic defenses. You'll learn how banks are minimizing false positives, speeding up investigations, and staying one step ahead in a world of cybercrime that never stops evolving.

What It Is

AI-powered anti-fraud and anti-money laundering systems are a significant change in financial institution defense against increasingly complex threats. Rather than the conventional rule-based systems, which depend on static thresholds and hard-coded logic, AI algorithms learn incessantly from enormous accumulations of past fraud incidents, real-time behavioral data, and sophisticated network traffic. These models don't respond—they predict.

By creating sophisticated profiles of customer behavior, AI systems create a living baseline for what's normal for any particular customer. If something diverges—perhaps a strange login location, an uptick in transfers, or a change in transaction timing—the system can flag it for examination in real-time. And it doesn't end with a single anomaly. They also reveal larger trends, spotting related accounts, money flow networks, or concerted behavior that may signal organized fraud rings or laundering operations.

At the same time, AI's ability to enhance itself in feedback loops is why its accuracy only continues to get better with time. Each verified case of fraud helps the system refine its signals. Each false positive helps it calibrate its sensitivity. The result is a system that grows sharper, faster, and stronger with each transaction it sees—delivering a level of vigilance no human team could possibly match.

Use Cases

The most direct use of AI in this case is monitoring transactions in real time. Whenever the customer swipes a card, transfers funds, or logs on, machine learning algorithms evaluate the transaction in milliseconds. Does the device seem to be familiar? Does the spending pattern align with what has occurred previously? Does the location align with where the individual normally goes? If something does not feel right, then the system can react in a split second—by blocking the transaction, asking for additional authentication, or notifying a human investigator.

Sanctions screening and watchlist filtering is another critical use case. Compliance teams need to ensure customers and counterparties are not on prohibited lists issued by governments or international bodies. AI tools now assist by screening names, aliases, and associated entities with remarkable speed and accuracy—far exceeding what's feasible with manual screening. These tools also reduce false positives, which have long clogged up compliance workflows and wasted investigative resources.

Behavioral biometrics is another new frontier. By tracking how clients type, swipe, or hold their phones, AI systems can build a digital fingerprint that's unique to every client. When a user starts behaving out of character—adopting a new typing rhythm, for instance—the system can flag the possibility of account takeovers even when login credentials are technically accurate.

This subtle defense layer adds depth to authentication and virtually eliminates fraud due to credential theft or phishing attacks.

Key Technologies

To combat today's fraud, banks are using some of the latest machine learning techniques. Graph neural networks are particularly useful to identify sophisticated, interconnected patterns.

The models represent transactions, accounts, and devices as nodes in a massive network and examine how entities interact with each other. If a new account, for example, begins interacting with a group of high-risk nodes, the system can flag it as part of a potential fraud ring right away—even if its own activity seems benign.

Unsupervised learning is also applied in anomaly detection. They do not require fraud examples labeled as such—they learn by finding out what is normal and then identifying deviations.

This renders them especially useful for identifying new or unprecedented patterns of fraud, in which established supervised models are likely to fail. Time-series analysis adds to this by scrutinizing the manner in which behavior unfolds over the course of hours, days, or months, enabling the system to identify gradual developments that could indicate sleeper accounts or slow-burn laundering operations.

Most significantly, these systems are often integrated into real-time decision engines. This allows banks to act in real time—blocking a suspicious wire transfer, freezing a compromised card, or alerting the customer—without interrupting legitimate users.

It is the ability to unify a diversity of technologies into one intelligent defense system that gives AI its edge in the high-stakes world of fraud prevention.

Impact

AI's influence on AML operations and fraud detection has been nothing short of dramatic. Companies that have embraced the technologies are seeing considerable decreases in fraud loss and more precise detection of suspicious activity.

More significantly, they're doing it without being inundated by false positives—a challenge that has long bedeviled legacy systems. By rendering alerts more precise and more actionable, AI is enabling compliance teams to concentrate on actual threats instead of pursuing ghosts.

Speed is another area in which AI can excel. Investigations that would have taken hours or days in the past can now be initiated in real time, with systems automatically gathering pertinent information, cross-referencing comparable cases, and generating initial risk scores. This not only speeds up response times but also improves the likelihood of preventing fraud from occurring in the first place.

From a compliance perspective, AI solutions help banks maintain a strong regulatory position with less operational overhead. Through automation of screening, auditing, and case management, banks can keep up with increasing international regulations without continually increasing headcount. In the meantime, the greater visibility and traceability these solutions provide make it easier to demonstrate diligence to regulators.

Last but not least, and possibly most important, is trust. During an era of rampant cybercrime and web skepticism, customers must be assured that their money and data are safe. AI-powered defenses offer not just security but also reassurance—a quiet, robust barrier of security that strengthens the banker-client relationship.

Intelligent Process Automation (IPA)

AI is not only altering the way banks interact with customers—it's also revolutionizing the backroom machinery that powers banking operations. Intelligent Process Automation (IPA) is the combination of robotic process automation (RPA) and cognitive AI designed to handle intricate workflows that require accuracy and decision-making. The powerful combination enables banks to automate not just repetitive back-office procedures, but also processes involving reading documents, understanding intent, and responding contextually.

Here, we discuss how IPA is being leveraged to simplify customer onboarding, lower compliance expenses, speed up loan processing, and enhance operational resilience in banks globally.

What It Is

Intelligent Process Automation is a move away from task automation and in the direction of context-aware, AI-infused workflows.

Where classic robotic process automation is concerned with rules-based execution—such as copying data or initiating actions—IPO incorporates artificial intelligence to process semi-structured or completely unstructured data. IPA simulates human judgment, enabling automation to enter realms that were previously too subtle or inconsistent for machines.

What's especially revolutionary about IPA is that it can learn and adapt. By incorporating machine learning into document understanding software, banks can teach systems to identify various forms, extract pertinent information, and even flag anomalies on their own. IPA systems don't merely do something but get better over time, learning patterns and optimizing processes based on historical data and changing inputs.

The outcome is a new generation of automation that works across channels, departments, and data types. Parsing handwritten applications, verifying customer identity across databases, or reading policy text in real time—IPA provides banks with a more intelligent, adaptable set of tooling to propel operational efficiency. It's a technology that adjusts to complexity—liberating teams from drudgery while enhancing accuracy and speed.

Use Cases

One of the most clear use cases for IPA in banking is in the onboarding of customers. In onboarding a new customer, IPA can verify identity documents in real-time, cross-check information with internal and external databases, and confirm all regulatory conditions are satisfied. This makes what used to be a process taking several days into a seamless digital experience, both boosting customer satisfaction and compliance.

Aside from onboarding, IPA is automating mid- and back-office processes as well. Loan processing, for example, would normally entail document conversion, income or employment verification of data, and red flag checks. IPA performs these concurrently, shortening turnaround and lessening human error. In claims processing, it likewise extracts pertinent details, determines eligibility, and makes decisions via automated rules, throughput dramatically improved.

In compliance and regulatory areas, IPA is demonstrating tremendous value. These systems monitor transactions, customer correspondence, and documents continuously, sending issues to review or escalating only where required to human analysts.

This triage function alleviates operational strain and renders regulatory reporting more precise and timely. In a nutshell, IPA introduces agility into areas of the bank that were once bogged down by error-prone, manual processes.

Key Technologies

Natural Language Processing (NLP) and Optical Character Recognition (OCR) form the foundation of IPA's document-processing capability.

Together, they allow systems to not just read handwriting and scanned documents but also comprehend the semantic meaning of what has been written. Contracts, applications, and even e-mails can be read and answered by IPA systems without human intervention in the majority of instances.

RPA platforms powered by AI, such as UiPath and Automation Anywhere, offer the platform for creating scalable, intelligent workflows. They incorporate bots with cognitive services—such as AI-powered data extraction, sentiment analysis, or fraud detection—so that processes can extend beyond the mundane and into the domain of responsive, adaptive automation. They also offer orchestration layers that manage workflows across departments and systems.

At the decision layer, IPA uses machine learning algorithms and rule engines that mimic human judgment. The engines can automatically approve low-risk transactions, send exceptions for manual approval, and learn from feedback to minimize errors increasingly over time. It forms a feedback loop where the system gets smarter with each iteration, laying the foundation for continuous improvement at all levels of bank operations in speed, accuracy, and reliability.

Impact

Intelligent Process Automation achieves tremendous savings in operational cost by reducing human touchpoints and speeding up throughput between departments.

Activities that took hours of human time in the past—e.g., review of documents, data verification, or rules checks for compliance—can be completed in seconds by AI systems. It not only reduces cost but also enhances consistency and auditability, both of which are paramount in regulated industries such as banking.

Speed-to-service is a second foundational benefit. IPA enables banks to onboard customers, process loans, and react to compliance events more quickly than before, with the result being improved customer experiences and competitive differentiation. Quick, accurate processing creates trust, particularly for consumers who anticipate real-time bank interactions. Internally, quicker workflow assists banks in reacting more dynamically to evolving market demands or regulatory change.

Most valuable, perhaps, is the scalability and resilience IPA creates. Banks can handle volume spikes—such as during seasonal peaks or economic uncertainty—without headcount growth to match. And because these systems don't tire or require breaks, they can run 24/7 with minimal intervention. This operational responsiveness allows banks to scale sustainably while remaining efficient, compliant, and customer-focused.

Real-Time Personalization and Cross-Selling using AI

Banking is seeing a new dawn—one in which personalization is no longer a choice, but a norm. AI is making possible real-time, context-based interaction based on the behavior, needs, and preferences of each individual customer. Rather than one-size-fits-all product recommendations or blanket emails, banks today offer hyper-personalized recommendations on mobile channels, websites, and even call centers. What follows is the way banks are leveraging machine learning to power engagement, optimize lifetime value, and secure loyalty.

What It Is

Real-time banking personalization means the customer's digital behavior, transaction history, and life stage are analyzed to tailor products and messaging accordingly. As opposed to conventional segmentation, which groups customers into fixed demographic segments, AI-enabled personalization is not static—it reacts to real-time signals such as recent purchases, location, or even financial milestones. It makes each interaction timely, relevant, and contextual.

AI platforms ingest new data points continuously to update customer profiles. If a consumer gets a paycheck, goes to a travel website, and looks at credit card offers all in the course of a day, the system can infer likely interest in a travel rewards card in real time.

By examining behavior sequences across channels, banks can extend cross-sell promotions with almost perfect timing—driving user engagement and conversion.

This isn't simply about pushing products; this is about adding value. If a customer is consistently spending more than they're bringing in, an AI system can push them toward a savings vehicle or a budgeting app. If someone is using international transfers on a regular basis, the system can recommend a low-fee remittance product. By making each touchpoint relevant, AI personalization transforms marketing from a push function into a valuable, meaningful dialogue.

Use Cases

Banks are using AI to personalize mobile and web app experiences in real time. A repeat user may see a dashboard of most-used features, receive timely insights from recent activity, or be offered offers that mirror current expenditure. This responsive design increases stickiness and satisfaction—digital banking is made intuitive and alive.

AI is also transforming email and notification campaigns. Rather than sending the same credit card promotion to a thousand customers, systems create personalized content from behavior data. An avid traveler can be presented with an air miles card, while a young professional struggling to establish credit can be presented with a no-fee starter card. Such precision leads to increased open and conversion rates.

Most revolutionary, perhaps, is the advent of "next-best-action" engines. These AI platforms compute the optimal product, message, or service recommendation for every customer at any given moment. They weigh customer history, recent behavior, and even channel affinity to suggest action that is best for both business needs and customer needs. It's one-to-one at scale—delivering personal experiences to millions.

Key Technologies

Beneath real-time personalization are machine learning technologies such as collaborative filtering and matrix factorization. Such technologies recognize similarity among users and products, enabling banks to offer behavior-led, data-driven recommendations instead of preconfigured segments.

Coupled with transactional information and application usage data, these technologies emerge as drivers of personalized engagement.

Clustering algorithms are another key tool, which allows banks to define micro-segments that collect users around detailed behavioral profiles. These can then be addressed with targeted messaging or offers, and the system can continuously re-evaluate and reclassify customers as new information becomes available. This renders marketing more agile and precise, even in rapidly changing economic conditions.

Lastly, reinforcement learning incorporates an optimization layer over time. The algorithms learn from every interaction, optimizing strategies based on what is working for every customer. When a certain message type gets more positive reactions than another, the system evolves. Over the course of weeks or months, this develops a deeply personalized experience where the bank appears to intuitively know the customer—establishing trust, loyalty, and long-term value.

Impact

Personalization powered by AI has a quantifiable effect on customer lifetime value (CLTV) by driving relevance at each touchpoint in the banking experience. When product suggestions are timely and pertinent, customers are more apt to interact, convert, and stay loyal.

This boosts not just product acquisition but also long-term retention—converting one-time users into multi-product, active customers.

Levels of engagement also experience a steep increase when personalization is done right. Through predictive nudges, customized offers, or dynamic dashboards, customers are more inclined to relate to banks that appear to know them. This manifests in higher app utilization, lower churn, and deeper relationships on digital and human touchpoints.

Most directly measurable business impact is in cross-sell and upsell. Banks that utilize AI to get the right product in front of the right customer at the right time outperform banks that utilize generic campaigns. Cross-sell rates are higher, marketing dollars are more efficient, and customers receive fewer irrelevant offers—all of which lead to greater trust and brand loyalty.

Conclusion – From Strategy to Execution

AI can transform banking but Success will require more than models and algorithms. True transformation demands data readiness, solid infrastructure, and sound governance foundations. If the data is not clean, organized, and available, even the most sophisticated AI will fail.

Likewise, if the infrastructure does not support real-time decision-making and governance does not provide assurances of ethical use, AI projects can stall—and worse, fail. To begin with, the banks must think small, tackling use cases with clear ROI and bounded complexity.

Explainability must be a top consideration, particularly in customer-facing applications or regulated processes. AI does not need to be placed in a corner by itself—it must be embedded into day-to-day workflows and decision-making, from the front office to the back. Finally, partnerships will be essential. No bank can do this alone.

Collaborating with the right AI vendors, platform providers, and data specialists can accelerate implementation and minimize risk. With the right mix of strategy, technology, and execution discipline, banks can turn AI from buzzword to competitive advantage—one intelligent workflow, one customized experience at a time!