Building a Scalable Infrastructure for Sustainable Digital Banking Operations

- Jun 27, 2025

- 19 min read

In the frantic rush to modernize, digital transformation is banking's new normal!

Transformation without scalability is superficial change, however—impressive, yet vulnerable. As customers' expectations escalate, regulatory scrutiny grows more complex, fintech disruptors rewriting the rules of speed and service, incumbent banks must confront a daunting question – can their business keep pace?

The solution isn't so much embracing new technology, but creating a foundation infrastructure that scales—efficiently, effectively, and strategically. Because it's not sufficient to digitize products or add a chatbot to your app. True transformation occurs below the surface, in processes, workflows, and support systems that inform every customer experience and compliance decision.

Scalable operations translate to less bottleneck, reduced cost, and quicker delivery. They enable banks to serve millions to the same level of standard as they serve hundreds—without burning out teams or breaking systems. But achieving it demands alignment at people, platform, process, and policy levels. It's a full-stack change, not a project.

This research slash guide outlines how banks can construct that type of operational resilience from scratch—so they not only survive the digital era but flourish in it. For in the modern era, scale is no longer a result—it's a strategy!

Executive Summary

Digital transformation has shifted from future strategy to current imperative. The rules of the game have changed for banks - it is no longer a matter of being digital - it is a matter of being scalable. The ability to grow, adapt, and perform consistently under stress is what separates leaders from laggards in this new normal.

However, most banks continue to depend on fragile legacy infrastructures, siloed systems, and manual processes that render scaling painful and costly. Even the most advanced digital solutions cannot make up for an operating model that cannot bend to demand. What is required is a change in mindset—one that views scalability not as an IT investment but as an enterprise capability.

Scalable infrastructure bridges the innovation-execution gap. It makes product launches faster, compliance in real-time, decisions data-based, and customer journeys robust—without bloated overheads. But more than technology, it takes to build. Banks must get people, processes, platforms, and compliance practices harmoniously working together as a future-proofed engine.

This paper presents a hands-on, step-by-step guide to doing just that. We demystify everything from identifying operational bottlenecks to infusing agility into business-as-usual processes. This is how banks can future-proof core operations for sustainable digital growth. Because in a fintech-speed world, scalability isn't operational—it's existential.

Why Scale Matters – An Operational Perspective

In a digital-first reality, banking operations need to be constructed to manage enormous volumes of transactions, real-time interaction, and constantly evolving compliance requirements — all without compromising performance, velocity, or customer experience. As services proliferate and digital interaction becomes the new norm, legacy infrastructure and inflexible workflows simply aren't designed for today's pressures. Scalability is no longer a back-office issue — it's a driver of growth, driver of resilience, and competitive necessity.

This chapter discusses why banks need to look beyond fragmented improvement and begin to think holistically about scale — developing operations with the ability to flex, grow, and adapt to market demand and technological advancement.

1.1 Changing Customer Expectations and Volumes

Customer expectations of banks have been changing more quickly than most institutions have been able to keep up. The typical user now demands the same immediate, frictionless experience they receive from PayPal or Apple Pay—whether they're conducting a transfer, taking out a loan, or calling for help. That implies 24/7 availability, no waiting, and hyper-personalization.

Traditional operating models, based as they are on large volumes of batched processing and departmental silos, simply can't provide that degree of immediacy.

Meanwhile, overall levels of digital interactions have risen exponentially. From millions of real-time payments to constant mobile app logins and API calls from third-party fintech providers, banks are facing unprecedented transactional strain. Each customer touchpoint—human or digital—contributes to the load. Lacking scalable systems, even moderate spikes in activity can form bottlenecks that harm user experience and confidence.

Scalable operations are designed to take in this growth without missing a beat. Scalable operations enable banks to ramp up throughput without sacrificing speed, accuracy, and security. More importantly, they divert attention away from response-driven problem-solving and toward proactive experience creation. By looking ahead to volumes ahead and designing operations to bend with demand, banks can get ahead of expectations—rather than perpetually struggling to get there.

1.2 Regulatory Complexity and Cost Pressure

As banks push into new products, markets, and digital channels, the web of compliance they need to work through grows more knotted—and expensive.

Every jurisdiction brings additional regulations, reporting requirements, and risk considerations to manage. At the same time, international organizations such as the BIS and FATF keep elevating the bar for AML, cyber, and operational resilience expectations. For banks lacking compliance designs that scale, getting ahead of the curve becomes a people-intensive juggling act.

Legacy systems make compliance an afterthought—bolted on, not built in. The result is redundant effort, fragmented audits, and huge expenditures on consultants, manual review, and remediation. Even worse, it creates delay. It can take months to execute regulatory changes, which exposes banks to the risk of fines, reputational damage, and customer loss of trust.

Scalable operations are different. They bake compliance into daily activity through automation, centralization, and standardized processes. Instead of adding bodies or bolting on older systems, scalable models leverage integrated platforms and real-time monitoring to simplify oversight. That not only lowers cost but makes the institution more agile in the face of new regulation. Lastly, scalability turns compliance from a bottleneck into a competitive edge—a source of speedier innovation with less risk.

1.3 Speed, Efficiency, and Resilience as Outcomes of Scale

Scalability isn't about doing more, but about doing better. When operations are well scaled, they release speed, shed waste, and increase the ability to absorb shocks.

In today's dynamic world, that triad is vital. Whether you're rolling out a new digital loan product, handling a sudden surge in account openings, or responding to a cyber incident, scalable systems respond with consistency and control.

Speed is a competitive advantage. Scalable banks get from idea to launch in weeks, not quarters—taking new products to market ahead of competition and iterating in real-time based on customer feedback. Efficiencies also increase, as automation, reusable code, and repeatable workflows take the place of repetitive manual work and workarounds. Human capital is released for higher-value work, propelling employee productivity and engagement.

And finally, there's resilience. In a world with operational risks ranging from cyber threats to climate disasters, scalable infrastructure is more than just about uptime. It's about continuity under pressure. It's about seamless failover, real-time visibility, and the capacity to reroute, reallocate, and recover without skipping a beat. For banks, these are no longer nice-to-haves—they're the standard. And scale is how they get delivered.

Operations Bottlenecks in Traditional Banking Models

You can't scale on shaky ground. Legacy infrastructure, designed for an earlier age, is hampered by technical debt, siloed systems, and manual processes. It bogs down everything—new product launches, regulatory compliance, you name it—and innovation becomes more of a weight than a game-changer.

Here we outline the key operational bottlenecks that limit traditional banking models from scaling effectively. Knowing where these cracks exist is the start of building a more resilient, nimble digital core that is poised for growth and disruption.

2.1 Steep Change and Product Introduction Costs

New bank product launch in a legacy environment is a marathon of cross-department coordination, redundant processes, and technical rework. Every new product—whether a mobile wallet feature or a digital credit offering—requires weeks or even months of effort, with cross-functional teams spread out across compliance, marketing, IT, and operations. The result? Slow speed to market, rising costs, and missed opportunities.

To this, we can add the brittleness of current platforms. The majority of conventional core banking systems are predicated upon tightly coupled architectures—alter one component, and you potentially destabilize the whole system. This brittleness militates against experimentation and innovation, and it is virtually impossible to respond nimbly to customer feedback or competitive threat.

Scalable operations flip this equation upside down. As banks embrace microservices, low-code platforms, and reusable APIs, product development and deployment friction is minimized today. This modularity allows features to be developed, tested, and deployed independently—compressing launch cycles, reducing costs, and unleashing a culture of continuous improvement.

2.2 Silo Compliance Generates Risk and Redundancy

In traditional banks, compliance is often performed in silos—AML in a separate system, KYC in another, and transaction monitoring in yet another. These siloed systems cause broken oversight, duplicative work, and no real-time visibility. When auditors or regulators arrive at the door, the institution scrambles to assemble reports from disparate sources at great cost and effort.

This siloed strategy adds not just cost but also danger. Inconsistencies among systems create blind spots that can result in regulatory violations, customer disagreements, and reputational harm. It also makes expanding into new markets far more difficult—each expansion involves replicating already-broken compliance frameworks.

A scalable solution makes compliance a shared responsibility woven throughout business. Centralized policy engines, unified case management, and real-time monitoring allow institutions to implement controls consistently—regardless of channel or geography. And this shift doesn't just reduce risk; it makes compliance a growth driver.

2.3 Restricted View of Data Across Functions

Information is the lifeblood of digital banking, but in the vast majority of institutions, it's flowing through blocked arteries.

Multiple systems, multiple formats, and multiple owners keep leaders from getting a clear, unified view of performance, risk, or customer behavior. It slows down decision-making and too often compels leaders to make decisions based on incomplete or old intelligence. Worse, such silos promote competing metrics across departments. Marketing may utilize one set of numbers, operations another, and compliance yet another — resulting in confusion, inefficiency, and internal strife.

In high-risk domains such as lending or fraud detection, the differences can have financial and legal implications. Scalable infrastructure solves this by establishing converged data architectures. Through real-time analytics platforms, data lakes, and well-defined data governance policies, banks can dissolve silos and facilitate smarter, quicker, and more assured decision-making. Visibility is not merely a reporting option, but a strategic capability.

2.4 Static Support Systems Affect Customer Experience

Today's customers demand instant, personalized assistance via chat, email, social media, or in-app messaging.

The majority of banks, however, are still using yesterday's support infrastructure built for static call centers and 9-to-5 business days. Those systems possess little to no integration with customer history, product consumption, and real-time transactional data, so agents are working in the dark.

The result is a frustrating support experience for customers and inefficient processes for agents. Simple requests like updating contact information or disputing a charge can trigger lengthy back-and-forth interactions, often across multiple departments and redundant verifications. This not only erodes customer trust but also contributes to operational overhead.

To achieve scale, banks need to rethink support as a smart, omnichannel business. AI-powered chatbots, unified customer relationship management, and adaptive knowledge bases enable banks to deliver faster, smarter, and more personalized support at scale. Most valuable, perhaps, scalable support solutions equip frontline workers to solve issues on first contact making support a differentiator.

Essential Elements of Digital Banking Infrastructure Scalability

Scalability doesn't begin with gleaming new technology but from the bottom up. Banks must reconstruct their core processes and systems in order to construct operations that yield and scale to demand. We discuss here the three pillars of scalable banking infrastructure: process optimization, data governance, and embedded compliance. These are not discrete initiatives but integrated competencies that support each other.

Done correctly, they turn banking operations from reactive and siloed into agile, intelligent, and resilient. Scalability is thus not just feasible, but unavoidable.

3.1 Process Optimization

Scaling starts with process redesign from scratch. Rather than stitching together flawed workflows, banks have to reimagine how fundamental services such as onboarding, payments, servicing, and dispute resolution need to work in a digital-first environment.

That means tracing customer journeys from start to finish, finding the friction points, and eliminating unnecessary steps.

Automation is the cornerstone of this reengineering. With the addition of robotic process automation (RPA), intelligent document processing, and event-driven architecture in daily operations, banks can significantly reduce turnaround times along with error rates. Manual interventions are reduced and personnel are released to perform more value-added activities.

Equally vital is the establishment of role-based workflows with inherent responsibility. Well-defined ownership of tasks, backed by system-enforced controls, guarantees consistency and visibility. When every crew knows its place in the value stream - and has the tools to act with certainty - the whole operation proceeds quicker, smoother, and with more confidence.

3.2 Data Governance & Security

Scalable banking just isn't possible without reliable, high-quality information. That takes more than centralization - it takes a complete-governance approach. Banks need to establish clear data ownership models, quality standards, and retention policies that balance performance and compliance.

Security needs to be designed in, not added on. Real-time encryption, ongoing monitoring, and automated audit trails are no longer optional in the current threat environment. As banks become increasingly digital and API-driven, these protections need to extend across third-party integrations, mobile channels, and cloud environments without reducing speed or ease of access.

It is also important to prepare for global data regulations such as GDPR, DORA, and others. Scalable data strategy involves privacy, sovereignty, and adherence to regulations in how data is collected, processed, and shared - making compliance a benefit, not a threat.

3.3 Compliance as an Embedded Function

Classic compliance occurs in snapshots - monthly check-ups, quarterly audits, and yearly checks. Yet digital banking requires ongoing vigilance.

The only way to stay ahead is to integrate compliance into business and IT processes. That implies a shift from manual reviews to automated controls and from reactive alerts to predictive risk monitoring. Automated reporting and self-healing controls minimize the burden on compliance teams and eradicate the lag of customary review cycles. Rather than discovering issues after the fact, scalable systems detect anomalies in real-time and trigger resolution processes ahead of time.

Above all, compliance has to function as a single model across associated legal, risk, IT, and operations. Such convergence gets everybody on the same playbook, with corresponding tools and metrics. When compliance is baked in - instead of being simply imposed - it turns into a source of speed, trust, and growth readiness.

Technology as an Enabler—Not the Driver

Tech decisions need to follow operations strategy—not vice versa. Many banks get caught up making bets on platforms without understanding whether or not they solve real workflow problems. A digital infrastructure that scales isn't built with the latest and greatest technology - it's built around real needs and long-term goals. Here, we talk about how to use the right tech stack to enable - not dictate—scalable operations.

4.1 Selecting the Appropriate Platform for Business Results

Picking the correct digital platform isn't a branding exercise—it's a strategic move that has to be guided by the bank's business goals. Platforms need to be evaluated on their potential to simplify essential workflows, enhance inner productivity, and provide frictionless customer experiences.

This encompasses assistance for end-to-end procedures such as digital onboarding, AML verification, real-time notifications, and customer service automation. An effective platform removes bottlenecks, automates cross-department handoffs, and minimizes manual involvement.

Rather than vendor reputation or technical buzzwords, banks must map platform functionality directly back to business priorities and operational pain. Does the platform reduce time to process loan approvals? Can it handle real-time compliance reporting in multiple jurisdictions? These are the questions that matter. What you're looking for is not automation, but intelligent orchestration—systems that learn how your bank works rather than requiring you to adapt to their processes.

Along with that, the platform should be capable of providing future flexibility in open standards, API access, and modular extensibility. It should be readily integrated with current systems and be sufficiently configurable to address evolving regulations or customer requirements. A platform that cannot grow with your company will become a roadblock, rather than an accelerator. Strategic alignment—not surface-level features—should be the foundation of every technology decision.

4.2 Cloud, APIs, and Modular Architecture

Cloud-native infrastructure is the underpinning of a scalable banking business. By transitioning away from fixed on-prem systems and into elastic cloud environments, banks achieve the capacity to dynamically scale resources, decrease capital expenditure, and deploy updates without downtime.

Whether managing a spike in digital payments or onboarding a new product segment, cloud platforms introduce agility at every level of the tech stack. Most importantly, perhaps, they introduce geographic redundancy and multi-region deployments, building resilience across markets.

APIs are the glue of next-generation banking. An API-first strategy enables banks to decouple services in a manner that allows data to be exchanged quickly between systems and third-party apps integrated easily. This enables product teams to embed fintech functionality, automate anti-money laundering checks, or introduce personalization tools without reengineering core systems. APIs also minimize vendor lock-in by opening the ecosystem to plug-and-play modules.

Modular architecture—particularly through microservices—extends this flexibility even further. Rather than being tied to monolithic applications, banks can divide their systems into discrete, separately deployable modules. This yields continuous delivery, quicker iteration, and laser-like innovation. If fraud detection requires an update, it can now be updated independently of the rest of the system.

This not only enhances speed-to-market but also fosters an environment where experimentation and rapid learning become ingrained in the operational DNA.

4.3 Strategic Vendor and Integration Management

Banks are more reliant on growing networks of third-party vendors—everything from cloud computing services to KYC check software. And with that heightened reliance comes more operational risk.

Effective vendor management starts with the creation of rigorous selection criteria and constant monitoring of performance. Banks need to spell out firm SLAs for uptime, response time, data ownership, and problem resolution. These agreements cannot merely be legal protection—they need to codify operating expectations that are aligned with the bank's business goals.

Beyond legalese, integration also needs to be seamless and long-lasting. In other words, it should have a cohesive architecture to onboard, test, and upkeep third-party tools without interfering with core operations. Middleware solutions, shared APIs, and centralized monitoring systems can minimize integration friction. Technical debt is a risk with the expanding vendor ecosystem.

To mitigate this, banks need to audit third-party dependencies regularly and invest in low-code integration platforms to minimize development constraints. Strategic vendor management also demands robust internal governance. Cross-functional vendor committees must review vendor performance, roadmap alignment, risk exposure, and data compliance on a regular basis—not solely at contract renewal.

Vendor relationships must change with the bank's strategy. That involves re-examining fit as markets shift, technology progresses, and new regulatory demands surface. A disciplined, forward-looking approach maintains third-party partnerships on the asset side of the ledger—not the liability side—through all stages of growth.

4.4 Uptime and Business Continuity Maintenance

For virtual banks, each moment of downtime translates into lost business, shattered customer confidence, and regulatory attention.

Delivering always-on operations takes more than just solid infrastructure—it takes a focused commitment to resilience. This involves multi-zone cloud deployments, regional load balancing, autoscaling services, and hot failover. Redundancy needs to be engineered into every layer, from the data tier through to the front-end interface.

But resilience does not stop at infrastructure. Business continuity demands a choreographed response from the IT, operations, and customer service organizations. Each of the teams must have well-documented playbooks for incident response, service degradation, and outage communications. Disaster recovery drills, penetration testing, and tabletop simulation exercises must be part of the operational calendar with regular frequency.

Banks must plan not only for technical outages but also for cyberattacks, regulatory blackouts, and supply chain disruption. Operational transparency is crucial too. There must be real-time system health dashboards, automated alerts, and escalation procedures to identify problems before they build up. Incident information must be utilized to enhance responses in the future and remove root causes. Business continuity is not merely a matter of keeping the lights on—it's a matter of keeping customer confidence, regulatory compliance, and strategic momentum, regardless of what is thrown at it. Scalability and reliability must increase hand in hand.

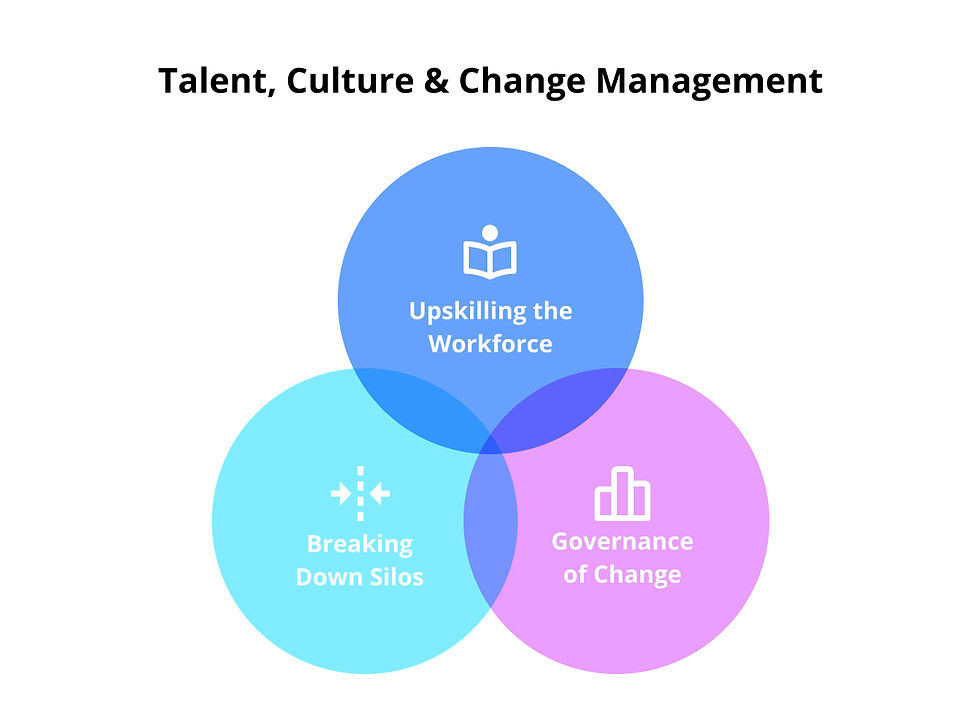

Talent, Culture, and Change Management

Scalable infrastructure is driven by individuals as much as platforms. Regardless of the most superior systems, without skills and cultural alignment, they will fail. This section addresses the human dimension of operations transformation—how to skill up teams, facilitate collaboration between business and tech units, and create a culture of continuous improvement.

With processes and platforms in transition, governance and discipline of change take center stage. Building institutional muscle for experimentation, agility, and learning from feedback ensures that the organization gets stronger—not just larger—when it gets bigger. Talent and culture aren't the last mile—they're the foundation for durable digital operations.

5.1 Upskilling and Reskilling for Digital Operations

The personnel that facilitate contemporary banking activities must be more technologically inclined than ever before.

Gone are the days when operations personnel could concentrate on paper-based checks or manual processes only. Nowadays, all functions in risk, compliance, and customer service require familiarity with digital tools—from CRM software and RPA robots to machine learning pipelines and data visualization platforms. Upskilling in these domains is no longer optional—but a prerequisite for operational efficiency.

Reskilling initiatives must be targeted and long-term in nature. Rather than one-off training sessions, banks must have ongoing learning pathways that incorporate hands-on labs, peer-to-peer learning, and formal certification. Front-line employees can learn to handle digital tickets or pass on AI-identified fraud signals, while back-office employees can learn to query operating data or set up process automations. Cross-training across departments also reinforces empathy and agility, breaks down rigid role silos, and energizes bottom-up innovation.

Furthermore, talent development must be linked directly to business results. Training programs must be mapped against metrics such as faster resolution time, increased automation percentages, or lower error rates. When workers see how their new competencies translate to organizational success, motivation and ownership increase. It does not mean digitizing the workforce, but rather enabling them to drive, test, and shape digital operations from the inside.

5.2 Breaking Down Organizational Silos

In spite of the potential of digital transformation, most banks are still internally siloed. Compliance, IT, operations, and customer service frequently run in parallel instead of in concert.

The siloed nature impedes decision velocity, duplicate effort, and promotes inconsistency in customer service as well as in risk management. Genuine scalability requires alignment between departments, not merely within them.

Coordination must begin at the architectural level—with common data, unified systems, and cross-functional KPIs. By focusing teams on outcomes instead of outputs, banks can facilitate accountability across functions. For instance, a common metric such as "time to resolve customer disputes" fosters collective responsibility between support and compliance. In the same way, product, IT, and operations teams can share ownership of deployment targets so that everyone is ready across the stack.

Culturally, leadership needs to model and reward collaborative behavior. Collaborative planning sessions, rotation programs, and shared ownership of initiatives serve to instill a systems-thinking mindset. Team designs such as agile squads or feature teams can establish natural collaboration cadences. Communication needs to be open and bi-directional, enabled by digital channels such as Slack or Teams. When all are aligned towards a shared vision, execution accelerates—and complexity is contained rather than daunting.

5.3 Governance of Change and Execution Discipline

Scaling digital operations takes more than passion—it takes discipline. In the absence of explicit frameworks for governing change, the most promising efforts can become mired in indecision, misalignment, or half-hearted implementation. That's why change governance must be baked into the operational DNA from the beginning—not as an afterthought when things go wrong.

An effective change management model incorporates formal ideation, piloting, scaling, and evaluation processes. This could be change councils made up of stakeholders from each department the change will impact that greenlight new projects and monitor progress against their established KPIs.

Agile sprints, retrospectives, and change logs maintain momentum while reducing disruption. These enable banks to learn fast, course-correct early, and iterate with certainty.

No less important is communication. Change fatigue is real—and can derail even the best initiatives if not managed. Leaders need to explain clearly the why, what, and how of every change, linking strategic intent to daily activities. Feedback mechanisms—through town halls, anonymous surveys, or internal forums—allow resistance to be raised early and addressed constructively. When change is a capability, not a phase, banks develop institutional resilience that underpins long-term growth.

Operational Roadmap for Scaling Up

Digital scalability is a process of operational maturity, not a project. This chapter provides a step-by-step action plan for banks to make the transition from legacy pain points to future-proof infrastructure. This chapter discusses how to measure current readiness, establish suitable metrics, prioritize initiatives, and establish governance for long-term success. It starts with unsparing assessment of current capabilities and concludes with institutionalizing change management and performance metrics.

6.1 Operational Readiness and Risk Assessment

Scaling starts with an honest and thorough analysis of where the company stands today. That means going beyond surface metrics and drilling down into operational work streams, platform functionality, process handoffs, and regulatory controls. Legacy systems, manual workarounds, and broken tools must all be inventoried, with an eye toward pinpointing inefficiencies that get in the way of scale—unnecessary approvals, siloed data stores, or compliance bottlenecks, for example.

Along with current-state workflow mapping, banks also need to measure their risk exposure as they scale. This encompasses operational risks such as single points of failure, third-party dependence, and cybersecurity vulnerabilities. For instance, a customer onboarding process dependent on one tool can turn into a bottleneck amidst times of exponential growth or vendor downtime. A risk-aware evaluation forms the basis of better-informed investment and sequencing decisions.

This testing cannot be a one-time exercise. It must be part of an ongoing operating maturity model where deficiencies are tracked and remediated over time. Having compliance, IT, operations, and customer service stakeholders involved guarantees that readiness tests are end-to-end and cross-functional. By creating a baseline and repeatedly re-testing against it, banks can grow without adding weakness to the system.

6.2 Define the Metrics That Matter

Scalability is generally measured too narrowly—through the lens of customer growth or digital uptake. But actual scalability metrics focus on operational elasticity and quality of service under load.

Metrics like cost-to-serve, process cycle times, incident resolution speed, compliance lag, and customer throughput are far more revealing. Such KPIs tell a story about the degree to which the organization can handle growing demand while maintaining control and quality.

Every business function must have customized metrics mapping to overall business objectives. For example, the compliance function may be working on decreasing time-to-alert in suspicious activity monitoring, and the customer service organization may be measuring problem resolution over digital channels. They must be clear, actionable, and linked to ownership—so that teams can course-correct without requiring executive intervention.

Just as important is benchmarking those metrics both over time and by channel. If chatbot usage goes up but resolution time surges, digital scale illusion may be obscuring a service gap. The goal is to create a metrics system that identifies where performance breaks down under scale pressure—and sends up early warning signals when operational integrity is in jeopardy.

6.3 Prioritize High-Impact Workflows

Not all processes are equal when it comes to scaling operations. High-volume, high-friction use cases such as onboarding, Know Your Customer (KYC), payments processing, and customer servicing are the most likely to be ripe for digital transformation.

These are the fundamental journeys that directly impact both customer experience and operational cost—and return the most ROI when optimized.

Automating these kinds of workflows does more than simply reduce labor costs. It also minimizes human error, speeds service delivery, and provides cleaner data for downstream analytics. For instance, a digitized onboarding experience that includes real-time identity verification, pre-filled forms, and embedded compliance rules can cut onboarding time from days to minutes—while being audit-ready.

Prioritization needs to come from cross-functional teams and customers. Which pain points do you hear most often on service calls? Where are the bottlenecks when demand peaks? Mapping transformation initiatives to such high-leverage points guarantees that technology investments yield tangible, noticeable improvements in efficiency and customer satisfaction.

6.4 Invest in Data Infrastructure

Scalable digital banking is powered by data. However, most banks continue to grapple with fragmented data pipelines, manual reporting, and stale dashboards. Banks need to invest in an integrated data infrastructure that facilitates effortless ingestion, processing, and distribution to every layer of the organization for real-time decision-making and intelligent automation.

Data infrastructure must be modernized to center on streaming capability, event-driven architectures, and centralized data lakes enabling both unstructured and structured data analytics. This would enable teams to act dynamically to the needs of customers, regulatory requirements, or risk alerts. For example, real-time behavioral analysis can identify suspected fraud during a transaction—before it affects the customer.

But it is not just about collecting data—it is about making it usable. Metadata tagging, access controls, and self-service analytics platforms democratize data access while maintaining governance. When employees can trust the data and use it without friction, it is a multiplier for innovation, compliance, and scale. Investment here is not discretionary—it is foundational.

6.5 Establish a Central Governance Layer

As banks grow, coordination becomes essential. Without effective governance, operational sprawl and tech debt can sap agility. A governing layer at the center delivers the oversight, alignment, and performance monitoring necessary to grow sustainably. It is the nerve center for initiative prioritization, standard enforcement, and cross-functional conflict resolution.

This layer of governance must be equipped with well-defined ownership models, cadence-based reviews, and decision-making bodies such as change advisory boards or operational excellence councils. It's enablement—not control. Teams, if they understand rules, escalation points, and success definition, will go quicker with reduced risk. Governance need not slow things down—it needs to expedite safe scaling.

Central governance also delivers continuity. Teams cycle through, vendors switch, and strategies evolve—but the continuity of institutional memory and directional alignment is ensured with a governance model in place.

It also acts to integrate compliance demands, customer obligations, and performance metrics into one coherent operating model. Scaling is not just a tech issue—it's a coordination issue, and governance is the glue.

Conclusion

Digital banking scalability is not about more—about better. It's the discipline of operations that delivers compliant, consistent, and customer-first service at any scale.

Transformation leaders and COOs are given a clear mandate – build a digital backbone that scales with demand, integrates beautifully with partners, and performs robustly in real time. Success isn't leaping onto every new shiny platform, but mapping people, processes, and platforms to meaningful results. It's redefining how teams are trained, change is managed, and performance is measured. It's a fundamental transformation—where cloud-based solutions, modular architectures, and intelligent metrics allow teams to achieve more with less friction and greater confidence.

The future of banking is for those who scale smarter—not larger. That means investing in flexibility, figuring out how to institutionalize it, and thinking about operations as a strategic asset. Scalability from the COO's desk isn't something to tick off—it's a mindset. And within that mindset, operational maturity is the metric of digital success!