Guide:

Best Agency Banking Software Solutions in 2025

Agency banking is rapidly expanding as banks and fintechs seek cost-effective ways to reach underserved communities. It supports financial inclusion, improves risk management, and enables broader product availability. This guide explores what agency banking is, its key benefits, how to choose the right software, and which platforms lead the market in 2025.

Author: Alena Tomchuk

Last updated August 21, 2025

Contents

What Is Agency Banking and Why Does It Matter?

Agency banking is a model where banks partner with third-party agents, such as retail shops or kiosks, to deliver financial services outside traditional branches. It matters because it expands access to banking in underserved areas, lowers operational costs, and supports financial inclusion. This approach helps banks scale services efficiently while meeting customer needs locally.

According to the Center for Financial Inclusion, as of 2021, approximately 1.4 billion people worldwide were still excluded from financial services, primarily in Africa, Asia, Latin America, and the Middle East. This exclusion creates challenges in saving money, investing, and accessing credit, hindering economic growth and development, and limiting people's ability to realize their full economic potential. However, adopting agency banking software solutions is the key to addressing this significant issue.

These advanced banking software solutions utilize digital platforms, mobile applications, and secure transaction gateways to redefine banking services' delivery. Through local agents, individuals in underserved areas can seamlessly deposit and withdraw funds, access credit, and engage in digital financial transactions. This is crucial in bridging the gap and fostering financial inclusion for underbanked people

How Does Agency Banking Work?

Agency banking works through licensed agents who act on behalf of banks to offer services like deposits, withdrawals, bill payments, and account openings. Transactions are processed using secure digital platforms connected to the bank’s core system. Velmie provides the infrastructure to integrate agents seamlessly, ensuring compliance, real-time reporting, and scalable service delivery across regions.

Agency banking stands out as a strategic approach within the financial industry, employing authorized agents to deliver financial services to customers in remote and underserved areas, beyond the reach of traditional branch networks. This innovative method emerged as the most effective means for banks and financial institutions to cater to consumers in rural regions, particularly in emerging markets where building branches is too expensive.

In the agency banking model, agent networks play a pivotal role. They provide a flexible and low-cost distribution channel, ensuring both cost efficiency and service security and compliance. Recognizing that rural consumers face tech challenges, agents step in as more than just transaction facilitators. They assist in explaining banking products, guiding through digital processes, verifying identities, overcoming barriers, and making financial services accessible to all.

-

Financial institutions. They are service providers that form the system's backbone, hosting the financial services available to agents for consumer delivery. All field agents must have an account with these providers to facilitate transactions on their behalf.

-

Agents. There are different types of agents: mobile agents without a fixed location, merchants and small store owners. Their role is to process customer requests and provide services to them on behalf of the bank or financial institution.

-

Agent network. In certain scenarios, banks may have field-based employees who are overseen and integrated into the agent network. Typically managed by agent network managers, who supervise agents, and handle float management, marketing, branding, and other related activities.

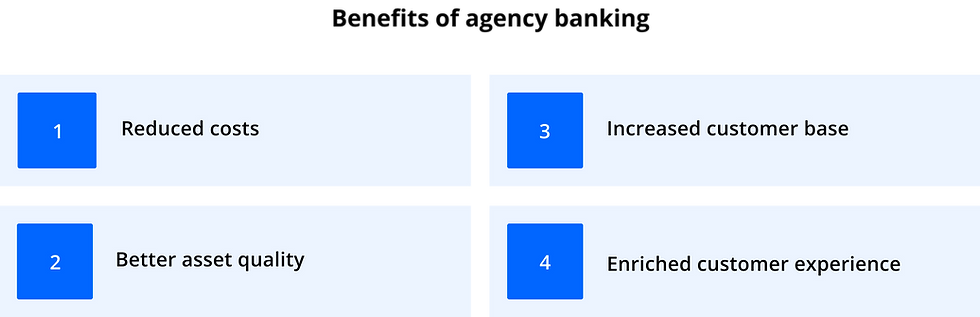

Advantages of agency banking for banks and financial institutions

-

Reduced costs. Agency banking provides a cost-effective avenue for banks and financial institutions to broaden their services in areas with lower bank penetration. The model eliminates the need for physical branches, resulting in reduced operational, infrastructure, and maintenance costs, as well as other high-capital investments. This approach allows banks to achieve dual benefits. Firstly, it saves costs associated with establishing new branches, as maintaining traditional banks is approximately 25% more expensive than managing an agent network. Secondly, it enhances profitability by capturing business from previously untapped areas.

-

Increased customer base. Banking agents enable banks and financial institutions to broaden their customer base by providing services to a larger population of unbanked and untapped customers. This expansion in customer numbers has the potential to result in a substantial increase in profits for banks.

-

Better asset quality. Banking agents often possess insights into clients' financial situations, understanding factors like repayment capacity and stability. This knowledge aids banks in making informed decisions when considering lending. Consequently, banks can effectively uphold the quality of their assets, safeguarding their financial health.

-

Enriched customer experience. Agency banking, also referred to as branchless banking, enables banks to bring their services directly to users, eliminating the need for them to visit a physical branch. Users can conduct various banking operations through agents, including fund withdrawals/deposits, bill payments, loan transactions, and more, using just a formal ID or biometric verification. Offering a user-friendly platform, agency banking provides diverse banking solutions for the unbanked population. This is achieved through the use of phones, card readers, POS (point-of-sale) terminals, and other advanced technologies that facilitate real-time transactions.

Please fill out the form to get Velmie Agency Banking case study

Please check your email after submitting the form

How to choose agency banking software?

When selecting agency banking software, consider:

-

Security and regulatory compliance with local banking laws.

-

Field operations

-

Integrations

-

User-friendliness

-

Reporting

Numerous challenges hinder the effective delivery of agency banking services, including handling liquidity, establishing an agent network, and ensuring agents comply with regulations. Choosing the right agency banking software is vital for meeting business objectives and enabling successful agency banking services. Velmie’s modular platform meets these requirements, offering customizable solutions for banks, MFIs, and fintechs.

Consider the following five essential points before selecting agency banking software:

Security and compliance

Securing customers' personal information poses challenges, prompting authorities in many countries to enforce strict rules for data protection, with substantial penalties for non-compliance by financial companies. Due to these regulatory requirements, the agency banking software must be adapted to adhere to the legal data management regulations of the countries where financial services will be provided through agency banking.

Given that many software solutions store data on cloud servers situated in different countries, compliance issues arise as most regulatory authorities prohibit data storage beyond their national borders. To address this, agency banking software must ensure that customer data is stored within national boundaries and provide the alternative option of on-premises installation.

Field operations

The agency banking software needs to adapt to market demands and challenges, including limited access to rural areas, inadequate technological infrastructure, and unreliable internet connectivity. A crucial feature is an offline mobile solution, essential for data collection and customer information storage, ensuring agents can provide services even in areas with no network coverage.

Addressing the issue of undocumented populations in emerging economies is another consideration. A significant portion of the population lacks formal identification, posing challenges for agents in delivering comprehensive financial services due to security and regulatory reasons. To overcome this, KYC procedures should involve software accessible with biometric devices, allowing the gathering of client data, including ID information, pictures, signatures, and more.

Integrations

With APIs, agency banking software facilitates seamless integration with other financial tools and services, such as accounting software and core banking systems. This integration streamlines financial processes, enhancing operational efficiency.

Reporting

Robust reporting and analytics tools offer valuable insights into agent performance, transaction trends, customer behaviour, and overall business growth. This data empowers banks to make informed decisions and enhance the effectiveness of their agency banking strategies.

User-friendliness

The platform should offer user-friendly interfaces for both financial institution employees and agents, ensuring smooth and efficient execution of their responsibilities.

Key use cases for agency banking services

-

Opening an account: digital onboarding. KYC.

-

Cash services: deposit and withdrawal.

-

Transfers: to own account, to another bank account, to a third-party wallet.

-

Top-up: airtime top-up, mobile top-up etc.

-

Bill payments: electricity and gas bills, tax payments.

-

Add-ons: balance request, statement inquiry, etc.

What Are the Best Agency Banking Software Platforms?

The best agency banking software platforms provide secure infrastructure, agent management tools, and multi-channel integration. Key players include global providers and regional specialists that focus on financial inclusion. Velmie stands out by delivering a modular digital banking core with agency banking features, enabling institutions to manage agents, onboard customers, and ensure compliance efficiently.

Velmie is a fintech company that develops cutting-edge technology for banks in emerging markets. Our platform simplifies and speeds up the creation of modern, reliable banking and payment products. It's designed specifically to work with the agency banking model, so you can set up new products quickly and easily, right out of the box.

Our platform offers key features that make it an ideal solution for agent banking:

-

API and integrations: Our strong API layer allows smooth integrations with a core banking system and other financial tools and services.

-

User-friendly UI: Intuitive and straightforward interfaces ensure a smooth customer journey and engagement.

-

Modularity: A microservices infrastructure makes our banking software platform modular and extremely flexible, allowing it to perform customizations, integrations, and extensions efficiently.

-

Security and compliance: We prioritize robust security measures and stringent compliance protocols to ensure a safe and regulatory-compliant financial environment.

-

Full tech support: Starting an agency banking journey can be complex, but we're here to help. We guide our customers through the process and provide comprehensive tech support every step of the way.

Sopra Banking Software offers a comprehensive suite of solutions tailored for the banking industry. Their portfolio includes core banking systems, digital wallet platforms, lending solutions, payment systems, and other software designed to meet the evolving needs of financial institutions. The company operates globally, serving a wide range of clients, including retail banks, corporate banks, and financial institutions. Their solutions aim to help clients streamline operations, enhance customer experiences, and adapt to the rapidly changing landscape of the financial services industry.

The company emphasizes innovation and the integration of advanced technologies to provide cutting-edge solutions. Their products often incorporate features like artificial intelligence, data analytics, and digital transformation tools to help financial institutions stay competitive.

Sopra Banking Software offers a flexible agency banking solution, delivering a comprehensive package of services that includes agent devices. Preconfigured with the AP front of distribution specifically designed for the agent network, this solution incorporates integrated features such as biometric solutions, embedded sensors, a storage platform, and authentication and signature processes.

Software Group is a global technology company that operates in more than 70 countries worldwide, serving over 100 clients, including financial institutions, microfinance institutions, and development organizations. The company offers a variety of software products and services designed to help organizations streamline their operations, improve efficiency, and reach underserved communities.

The company offers innovative digital banking solutions that enable financial institutions to provide a wide range of banking services through digital channels such as mobile banking and online banking. Software Group provides agency banking solutions that allow financial institutions to extend their reach by partnering with agents in remote or underserved areas to offer basic financial services.

The company has received several awards for its innovative digital solutions and impact in the financial inclusion space. Some of the awards include the European FinTech Award and the Financial Times' FT 1000 list of Europe's fastest-growing companies. Software Group partners with leading technology companies, financial institutions, and development organizations to deliver cutting-edge digital solutions and services.

Financial Software & Systems (FSS) is a globally recognized banking and digital payments company headquartered in India, boasting 150+ global customers, a dedicated team of 2500+ payment professionals, and a widespread presence across India, Africa, Asia Pacific, Europe, the Middle East, and North America.

The company offers a comprehensive payments portfolio comprising software products & custom solutions, as well as ATM, POS & hosted services. Leveraging over 25 years of expertise in the payments domain, FSS excels in issuance, omnichannel acquiring, digital banking, smart reconciliation, payment processing, monitoring, digital security, payment analytics, and financial inclusion, catering to various delivery channels and ecosystems.

FSS' clients include banks, central regulators, governments, financial intermediaries, third-party electronic payment processors, merchants, and payment associations.

Craft Silicon is a technology company based in Nairobi, Kenya, and has a global presence with operations in multiple countries, including India and the United Arab Emirates. Craft Silicon offers a wide range of software solutions for financial institutions, mobile network operators, and other businesses, including core banking systems, mobile banking solutions, international payments, and agency banking solutions.

The company provides an agency banking solution that enables financial institutions to extend their reach through a network of agents who can provide basic banking services in underserved areas. This solution includes agent management, transaction processing, and reporting features to facilitate agency banking operations. Craft Silicon has a strong presence in emerging markets, particularly in Africa and Asia and its solutions have played a significant role in advancing financial inclusion by providing access to banking services for unbanked and underserved populations through digital channels and agency banking networks.

Panamax offers mobile financial solutions and fintech services encompassing mobile money solutions, agency banking platforms, digital payments, and remittance solutions to enhance financial inclusion and expand access to financial services. The company has a global presence with customers across various regions, including Africa, Asia, the Middle East, and Latin America, catering to a diverse range of clients in the telecom and financial sectors

Its agency banking solution “MobiFin” covers the entire customer lifecycle including electronic KYC-based onboarding with biometrics, transacting, analytics for customer and agent management, credit scoring, agent management module, API integration, and security. The company leverages cutting-edge technologies such as cloud-based architecture, artificial intelligence (AI), and machine learning.

Modefin offers omni-channel & digital banking solutions to banks and financial institutions. The company serves about 60 banks in more than 20 countries. Headquartered in India, they have an on-ground presence and operations in the Philippines, Kenya, Ghana, and Dubai aimed to take financial services to urban and rural landscapes.

Modefin's agency banking solution is designed to enable agents to offer end-to-end banking services with low TCO for banks and financial institutions. It has built-in features for agent’s fees, commission, a self-care agency portal to ensure complete control to the bank, and software safeguards to mitigate risks such as cash theft or identity theft.

6D Technologies is a technology-driven organization that delivers innovative solutions for telecom, fintech, and enterprises. The company is dedicated to realizing a transformative experience by embracing forward-thinking technologies such as IoT, AI/ML Ops, Big Data Analytics, 5G, Cloud, and other innovations.

The company provides the Aureus agency banking solution, a comprehensive platform that includes digital self-onboarding, agency banking services, transfers, merchant payments, wealth management, shared wallets, utility payments, micro-loans, micro-savings, international remittances, and more. This platform offers a full suite of solutions, empowering financial institutions, telecom operators, and merchants to harness the potential of agency banking and reach underserved communities. The platform utilizes robust security measures and encryption protocols.

ICS Financial Systems (ICSFS) is a provider of modern banking and financial technology powered by a very solid, agile, and digital banking platform. Its ICS BANK Software Suites are fully integrated financial software solutions covering the universal, retail, wholesale, corporate, commercial, investment, Islamic, finance leasing, microfinance, and agency banking industries. ICSFS has been empowering banks and financial institutions for many decades and has witnessed the transformation of its customers from traditional ones to early adopters of online and mobile banking, modernization of core banking services and finally becoming a true global and digital bank.

ICS BANKS Agency Banking software suite plays a crucial role in aiding banks to reduce customer acquisition costs and promote financial inclusion. This is achieved through its inventive digital touchpoints and channels.

Codebase Technologies stands as one of the rapidly advancing fintechs specializing in open API banking solutions worldwide. Driven by a vision to revolutionize technology applications for a greater purpose, the company specialises in crafting meaningful digital financial experiences tailored for conventional and Islamic banks, fintechs, neobanks, lenders, and startups. The company has launched several digital, challenger, and neobanks and financial propositions across the UAE, Malaysia, Bahrain, the UK, and Africa.

Its agency banking solution enables financial institutions to expand their services to the farthest corners of their jurisdictions, effectively contributing to the global financial inclusion agenda. The solution empowers and equips merchants, agents, and other members of a bank’s or financial institution’s ecosystem to effortlessly deploy your financial products and services, ensuring a seamless experience without compromising quality.

Leads Corporation Limited has been the foremost information technology service provider in Bangladesh since 1992. Engaged in the design, development, implementation, and maintenance of business application software, LeadSoft caters to both domestic and international markets. The company specialises in offering core banking solutions (BankUltimus) to the banking industry, catering to both local and global clientele. Beyond banking, Lead Corporation Limited extends its products, services, and solutions to non-banking financial companies, agent banking, capital markets, life insurance, and enterprise resource planning (ERP), among others.

In recent years, the company has ventured into disruptive technologies such as blockchain, the internet of Things (IoT), and artificial intelligence (AI). This evolution has positioned LeadSoft as a prominent information and communication technology solution provider in Bangladesh, earning recognition as the preferred IT partner for effectively managing people, processes, and environments.

Novatti is a prominent player in the fintech market, specializing in digital banking and payment solutions. Their expertise lies in facilitating seamless payment processes for businesses, allowing them to send and receive payments effortlessly. Operating in 58 countries, Novatti enables businesses of all sizes to transition towards a cashless society by providing transaction processing, payment acceptance, card issuing, and subscription payment solutions.

With two decades of experience, Novatti offers a diverse range of technology solutions tailored for branchless banking, donations management systems, digital wallets, and more. As a Visa Principal Partner and Issuer, Novatti also supports fintech businesses in offering their customers branded prepaid cards. They are capable of issuing both physical and virtual Visa cards, empowering businesses to enhance their brand presence in the prepaid card market.

TOP agency banking software companies comparison table

Agency banking platforms differ in:

-

Scope of services (basic transactions vs. advanced digital banking).

-

Customization (off-the-shelf vs. modular design).

-

Pricing models (subscription vs. enterprise licensing).

Velmie offers a modular solution, balancing scalability and compliance, which makes it competitive against traditional one-size-fits-all providers.

Can Agency Banking Really Boost Financial Inclusion?

Agency banking reduces the need for physical branches, allowing banks to reach rural and underserved communities cost-effectively. By using agents, financial services like payments, savings, and lending become more accessible.

Agency Banking is transforming the banking industry in emerging markets, opening doors for thousands and bringing financial services to the unbanked population. Utilizing agent networks and expanding the range of services are crucial opportunities. Choosing the right platform is vital; it helps financial institutions reach more people, provide better service, and increase profitability. In summary, the choice of the correct platform for agency banking is crucial for achieving success. A well-suited platform empowers financial institutions to broaden their outreach, enhance customer service, and boost profitability.

With the Velmie digital banking platform, the process of launching agency banking has become significantly faster and more efficient. Instead of starting from scratch, you can leverage the white-label solution and significantly reduce your time-to-market.

You might also be interested in

FAQ

Q1. What is the main purpose of agency banking software?

A: Agency banking software enables banks and financial institutions to extend services through third-party agents. It helps manage transactions, monitor compliance, and ensure secure operations without building costly branch networks.

Talk to an expert at www.velmie.com/contact

Q2. How secure is agency banking software?

A: Modern agency banking software includes multi-factor authentication, encrypted transactions, and real-time fraud monitoring. These features safeguard customer data and maintain regulatory compliance.

Q3. Can small financial institutions use agency banking platforms?

A: Yes. Microfinance institutions, credit unions, and rural banks can adopt agency banking solutions to scale services affordably. Modular platforms allow smaller players to start simple and expand as demand grows.

Discover the case study at www.velmie.com/a2

Q4. What features should I expect in top agency banking software?

A: Key features include:

-

Agent onboarding and KYC tools

-

Transaction monitoring

-

Cash management

-

Integration with core banking systems

-

Compliance reporting

Q5. How does agency banking support financial inclusion?

A: By enabling agents to deliver services in rural and underserved areas, agency banking reduces barriers to accessing accounts, loans, and payments. This promotes financial literacy and economic growth.

Explore insights at www.velmie.com/a2

Q6. Which platform offers customizable agency banking solutions?

Some platforms provide out-of-the-box setups, while others allow customization to meet regional regulations and client needs. Velmie’s modular system lets institutions tailor workflows, services, and reporting.

Talk to an expert at www.velmie.com/contact

Q7. Can agency banking software integrate with mobile banking apps?

Yes, leading solutions integrate seamlessly with mobile apps, enabling customers to transact via agents or directly on their devices. This creates an omnichannel banking experience.

Learn more at www.velmie.com/contact